As an early-stage investor, you want the startups in your portfolio to succeed. It is common knowledge that young businesses have a higher-than-average failure rate (about 90% in the first few years). So, what can you do to pick out the firms with the highest chances for success?

Below, we highlight five common reasons for startup failure in 2024-25, how to identify the risks and how to mitigate them. We hope these insights are helpful. If you want to explore our pre-vetted startup projects here at Bure Valley Group, please get in touch.

#1 Cash depletion

Many startups fail for reasons similar to those of individuals going bankrupt: poor financial management. Perhaps the founders underestimate the costs of setting up their business. Other common problems include a lack of funding strategy and scaling too quickly.

An experienced investor can often spot the warning signs of these outcomes during early discussions with founders. Perhaps the owners have outlandish estimates of future revenues that are not reflected by competitors’ experiences in the marketplace.

Here, it helps to interview the founder(s) carefully to see how much due diligence the startup has done. Which costs could suddenly arise in the future (e.g. in product development), and can the startup remain financially stable?

On the other side, could the business respond quickly to an unexpected surge in customer demand? Would additional funding and staffing be available to meet consumers’ expectations and tap into the growth potential?

#2 Poor Team Dynamics

The pressure of working at a startup can be intense. The environment can be fast-paced and too much for some people to cope with. There can also be a high burden of responsibility on team members if they feel their work is “do or die” as the business tries to get profitable.

Common warning signs include arguments between founders (especially over vision and decision-making) and rapid hiring. The former can significantly undermine team morale as staff sense the lack of united purpose from their leadership. The latter can bring unsuitable people to the team due to poor screening/assessments.

Investors can guard their portfolios from unhealthy startups by physically visiting them regularly. Take time to carefully observe how people interact and ask people questions. What is it like to work there? Are they motivated and positive? Are there team-building activities going on?

#3 Ineffective Marketing

A startup may have the best team and value proposition. However, it will soon be in big trouble if work does not get out to customers.

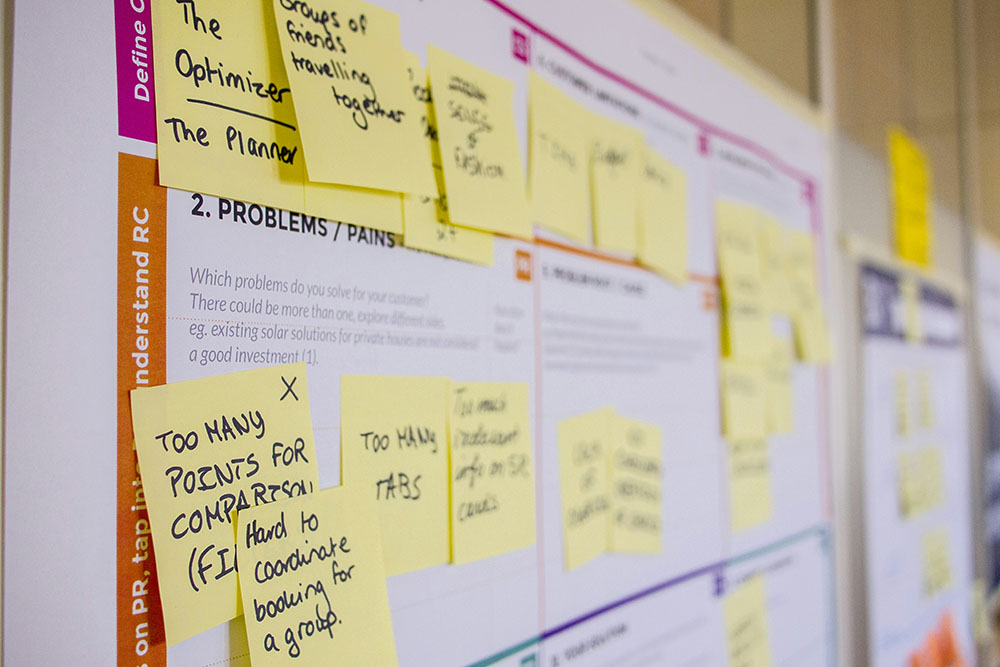

Early-stage businesses can struggle to grow due to a lack of expertise in marketing and a poor understanding of their target audience. For instance, many startups simply define their customer demographics (e.g. age, income and gender) but fail to go into significant depth about other key areas – e.g. “psychographics” (e.g. needs, goals and pain points).

Here, investors need to look for evidence of marketing prowess in the team – particularly among founders. How well do they know their market? Do they exhibit a deep appreciation of their customers’ problems, how they can address them, and how their value proposition compares to other options in the market?

#4 Poor Business Model

Many startups do not have clear and sustainable revenue streams. Others have revenues coming in, but the potential for growth is limited. Maybe the total addressable market (TAM) is too small, or perhaps the nature of the startup’s work is inherently unscalable.

Startups may be too reliant on a single revenue source. Investors can discern this without too much trouble by examining the financial statements. Naturally, the best course here is usually to diversify revenue streams. If one tries up, the business can still survive or even thrive.

Investors can also ask founders which small-scale tests have been done to validate the model before scaling. Here, there should be clear evidence of founders seeking to address common issues, such as properly establishing operational practices and creating a clear pricing plan.

#5 Competition

A startup may believe it has found a gap in the market. However, what if established players suddenly rush to fill it – pushing out the new entrant?

The existing “structure” of the market plays a big role in determining a startup’s prospects. Markets closely resembling the “perfect competition” model will usually be harder to compete on price (but harder to differentiate). Those with monopolistic traits could see existing corporations try to stamp out a startup on price, but the differentiated products can provide opportunities for survival and growth (e.g. if the business models of monopolies cannot adapt).

This is why market research is so important at the very beginning of a startup’s life. By “war gaming” different possible outcomes – involving existing players and possible new entrants -, an early-stage business can discern its possible routes forward and how to respond.

These five risk factors are just a handful of the common reasons explaining why startups can fail. Here at Bure Valley Group, our exclusive investor network exists to help empower investors to build robust early-stage portfolios – even enjoying tax benefits along the way (e.g. from the Enterprise Investment Scheme).

Want to speak to us about our early-stage opportunities here at our exclusive investor network? Get in touch today to explore our startup projects here at Bure Valley Group.