Funding Closed: Cudo

Cudo are developing a platform to use the world’s under-utilised computing capacity for commercial and charitable purposes. A greener cloud computing platform with significant cost savings for consumers and an income generator for charities and owners of under-utilised IT hardware.

Sector

Technology & life sciences

Projected 3 year ROI

44x round valuation

Funds sought

£1.5m

Minimum investment

£10k

The next generation cloud computing platform.

Over 50% of the world’s 2 billion computers and 2 billion smartphones are idle at any point in time, which equates to over $1tn in underutilised IT hardware. Cudo aims to leverage these dormant resources.

Cudo is the creation of Matt Hawkins, who founded the business in 2017. Matt is an experienced tech entrepreneur who previously founded C4L in 2000 – a network services and data centre hosting provider which was acquired in 2016 for £20m.

Cudo was started using £2m of self funding, and launched its beta in October 2018 to a user-base of 20,000 spread across over 130 countries. From the beginning of 2019 user revenue has steadily increased from $22,000 in March to $100,000 in July.

Chris Deering, ex-Chairman of Sony PlayStation, has invested and is now on Cudo’s advisory team. He has already introduced Cudo into Sony and negotiations are going well. Games consoles/gaming Pc’s have very powerful graphics cards and perfect for GPU workload demand on the network.

Highlights

Cloud computing was rated a $160bn industry in 2018, forecast to reach $227bn in total value by 2021.

Cudo’s Beta software has been validated by third party providers as the most profitable of its kind.

An xlarge AI resource on Amazon costs $9000/m. Cudo’s user base will accept $300/m from Cudo to provide the same resources.

Internal infrastructure costs scale minimally as 100,000s or millions of devices are added to the platform.

Current gross profit per standard users device ranges from £0.03 to £50/m. Some are in excess of £1000/m gross profit each.

Forecasted to bring £33m in Cudo revenue in 2021. Typical valuation multiples in this space for 100%+ growth are 10x ARR.

Discover more

How it works

Of course, investors are likely asking at this stage: “how does the company make its money?” In short, if any users’ hardware is used to generate a profit then Cudo takes a commission on that profit. At the moment, the percentage is set at 6.5% and will go to 10% on the mining platform and on the GPU.

For CPU workloads like AI Processing and Graphics/video rendering workloads, the commission is 30%. There are also 5 other proven revenue streams with many more potentials to be explored.

The opportunity ahead

Cudo’s distributed computing platform is suitable for approximately 40% of cloud computing tasks which is a $160bn industry in 2018 (IDC) and with CAGR of 21.9%, is forecast to reach $227bn in 2021.

There are many complex cloud computing tasks that Cudo’s software can offer including video rendering, real time data processing, AI & machine learning. Alone, machine learning is forecast to grow from $1.4bn in 2017 to $8.81bn in 2022, 44.1% CAGR (IDC). The key to Cudo’s design, is to make these complex applications accessible to a much wider audience through both cost savings and simplicity of use.

Sustainable competitive advantage

One of the primary attractions to Cudo for users concerns its pricing. Large, existing cloud computing providers such as Amazon AWS and AIBrain offer their services for thousands of pounds per month, making these solutions only accessible to Enterprise businesses.

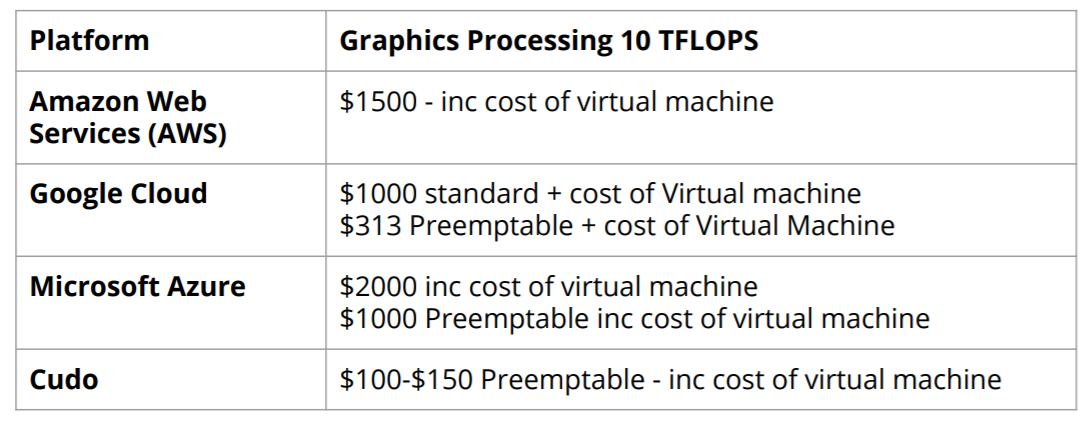

Here is a quick comparison table of Cudo in relation to competitors, at the time of writing:

Cudo’s business model also allows it to position its brand effectively as an ethical, environmentally-friendly cloud computing solution. Whilst large businesses like Amazon need to pull resources out of the ground to build new, large cloud servers, Cudo leverages existing computing infrastructure to provide its service.