Pharmaceuticals are a key area where the UK holds a competitive advantage on the world stage. It is also a sphere of exciting innovation – particularly with the development of biologics, which could revolutionise how we treat diseases. This industry report outlines the global market for biologics and pharmaceuticals in 2024. We include the latest trends, key players, rising stars, opportunities and risks for investors to consider as they build their portfolios.

Market Overview: Biologics & Pharmaceuticals

The global pharmaceutical market is significant. In 2017, worldwide revenues stood at USD 1,143 billion and have been growing at a rate of 5.8% since then. The biologics market is a related but distinct market, standing at USD 461.74 billion in 2022. Exponential growth is widely expected in biologics. By 2030, the market is forecasted to reach USD 1.37 trillion, with a compound annual growth rate (CAGR) of 10.4% between 2024 and 2033.

The biologics market can be segmented in various ways. By source/origin, its categories include Microbial and Mammalian. By product outlook, its applications include Vaccines, Recombinant Proteins and Monoclonal Antibodies (e.g. biochemical analysis and diagnostic imaging). On the geographic front, North America represents the largest market for biologics. However, the Asian Pacific region is also poised for substantial growth.

Key features and market characteristics

Biologics and pharmaceuticals are closely related. After all, they were both developed to treat diseases. However, they differ in many key areas, including composition, manufacturing processes, regulation and market dynamics.

Biologics are derived from living organisms or cells. Pharmaceutical products, by contrast, tend to be chemically synthesised (e.g. aspirin or statins). Biologics are larger and more complex molecules, making them more difficult to manufacture, standardise and replicate. Rather than being digested via a pill, they typically require injections or infusions.

Biologics also tend to fall under different rules. In the US, they are governed by the Public Health Service Act (PHSA), while traditional drugs fall under the Food, Drug, and Cosmetic Act (FDCA). The approval process is often more lengthy and vigorous. They are sensitive to environmental factors (such as temperature), thus requiring specialised handling, storage and distribution systems.

That said, these innovative large-molecule drugs are opening new doors to treating complex conditions that were previously hard to manage, such as cancers, autoimmune diseases and rare genetic disorders. For instance, biologics such as TNF inhibitors and interleukin blockers are now used to treat conditions like rheumatoid arthritis, psoriasis and Crohn’s disease. Indeed, biologics could allow us to make long-awaited breakthroughs in treatment across various medical fields, transforming healthcare across the world.

Trends, key players and new entrants

Many large, established pharmaceutical companies are heavily invested in biologics. These include brands like Pfizer, Roche, Amgen and Novartis. Roche, for instance, has pioneered Herceptin (trastuzumab) for breast cancer, and Amgen has produced Prolia (denosumab) for osteoporosis. Janssen’s biologics include Remicade (infliximab) for autoimmune diseases and Darzalex (daratumumab) for multiple myeloma.

The UK is a notable market for biologics. In 2023 alone, UK biotech companies secured £1.8 billion in funding. The country is also an exciting hub for biologics startups. An example is Ascend Gene & Cell Therapies. Based in Potters Bar and founded in 2021, the firm partners with biotechnology teams to support manufacturing and process development projects. To date, they have raised over €122 million in funding.

Another case study is Clock Bio in Cambridge. The firm’s goal is to “reverse the harmful effects of time in our cells” using human pluripotent stem cells (which have regenerative capabilities). So far, the team has raised €3.7 million in funding and is focusing its efforts on “enabling a comprehensive decoding of rejuvenation biology …to create novel treatment approaches.”

A third interesting UK startup is ExpressionEdits in Haverhill, West Suffolk. The firm has niched down onto the design of synthetic DNA instructions, using an AI-powered platform and machine learning to optimise gene design. So far, the firm has raised €12 million to redefine the status quo of protein expression.

Risks & opportunities

Investors will naturally be attracted to the high potential returns from a “breakthrough” drug developed by a pharmaceutical or biologics firm. This sphere of investing also offers an immense sense of purpose. By partnering with innovative drug developers, investors can provide the “financial fuel” needed for firms to create transformative healthcare solutions. You are not merely seeking returns. By investing, you could help change the world.

Biologic drugs are often more expensive than traditional small-molecule drugs. This opens the door for premium pricing and high growth potential (due to high-profit margins). Investors can take reassurance that biologics are harder to develop and manufacture compared to small-molecule drugs, raising the barrier to entry for competitors.

However, biologics involves a significant amount of research and development. There is typically a requirement for heavy investment in clinical trials, regulatory approvals and specialised manufacturing facilities. The regulatory scrutiny can be intense and uncertain, raising risks for investors.

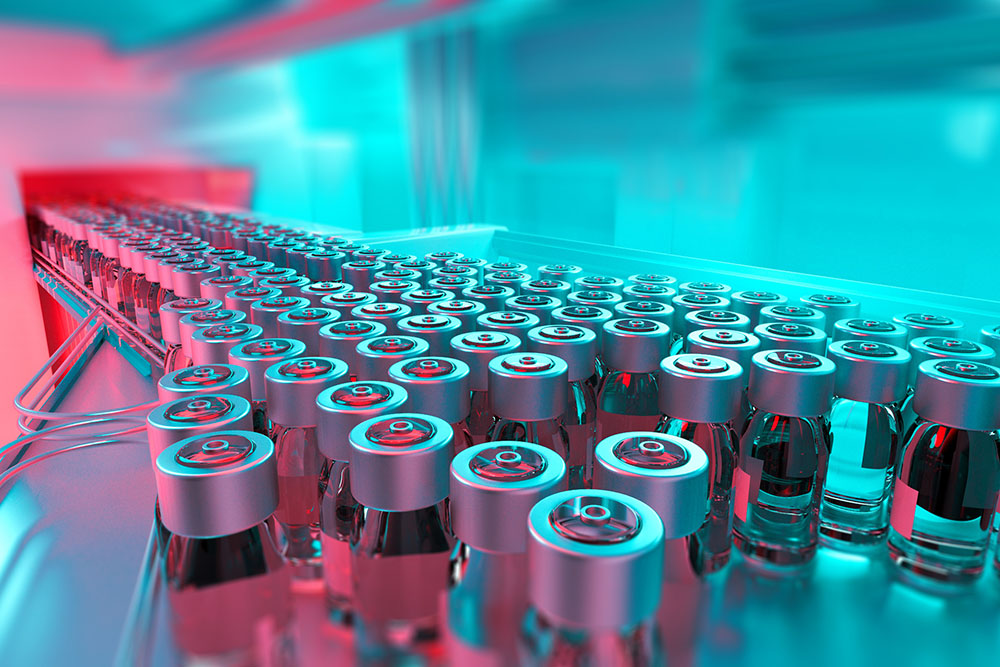

Biologics requires specialised manufacturing plants, precise conditions (like refrigeration and sterile environments) and cold chain logistics. Any disruptions in the supply chain or manufacturing issues can significantly impact production and availability. There is also a higher risk of contamination during manufacturing.

To mitigate these risks, the time-honoured principles of due diligence and diversification will stand early-stage investors in good stead.

Invitation

If you are interested in expanding your portfolio into these kinds of exciting spheres of investing, then we invite you to get in touch with us here at Bure Valley and consider joining our exclusive investor network:

+44 160 334 0827